The Best Net 30 Account For Long Term Success

What Is Net 30? Easy Approval For New Businesses.

Net terms (like Net30) simply mean an agreement between you and another business for when your payment is due. The number following “Net” are the days you have to remit payment on the invoice that is sent. Common terms for Net accounts are 30, 60, and 90 depending on the industry you work in. There are other Net terms such as 10 or even 120 that are also common.

Net30 terms differ from subscription models.

Net30 are not automatic subscriptions where your credit card is automatically charged. Monthly subscriptions like Netflix, Apple Storage, or Google Services operate as a cash account or pay in advance account and don’t constitute Net30 terms — the service isn’t provided on credit, there’s limited risk involved.

Net30 terms typically revolve around invoices. Access to the software, service, or goods are provided in an immediate manner, an invoice is sent, and due within 30 days. The monthly dollar value of service and retail Net30 accounts are typically low, so while there is some risk involved it is a limited extension of credit by the offering business. This is great for new and small businesses as the lower limit of credit extended means more lenient approvals; for example no personal credit check. This low limit of credit extended isn’t true for all industries, manufacturing and supply-chain vendors will typically offer higher limits for extended periods of time but they may require more documentation or guarantees..

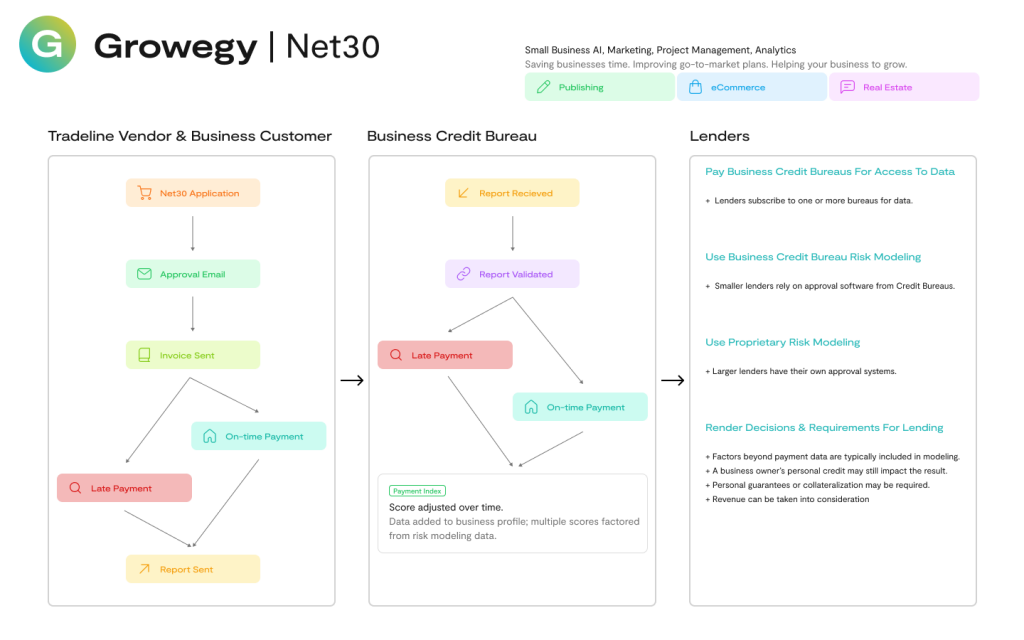

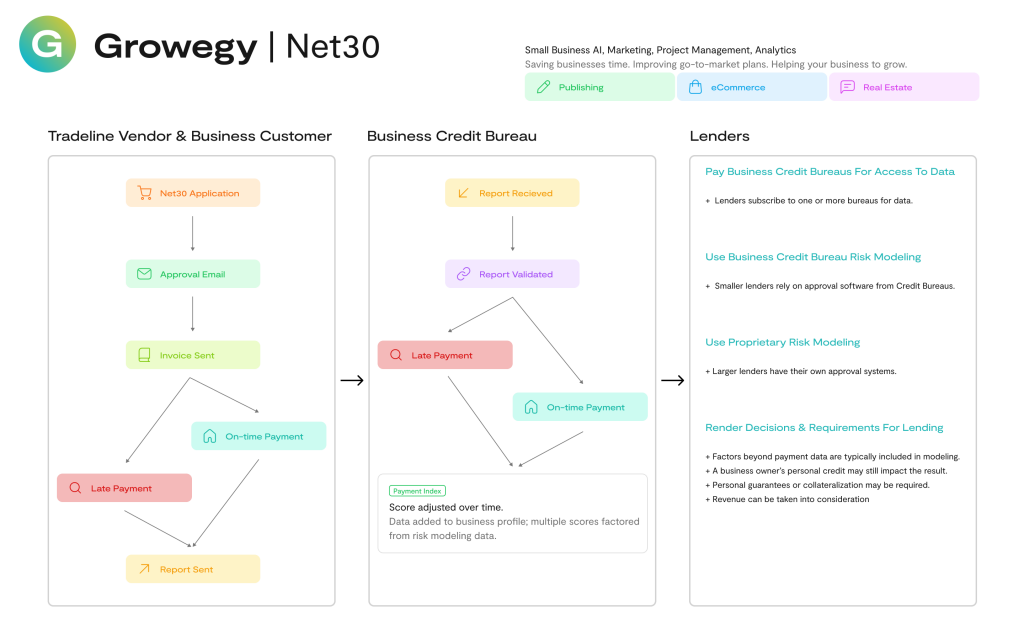

How Net30 accounts create business credit history; tradeline data and scores.

Business/corporate credit are evaluated differently than personal credit, even by the same credit bureaus. The scores are called different things (Payment Index as an example) and are calculated uniquely. Business credit is not uniformly regulated like personal credit is. So while bureaus may have similar named scores it is important to understand what goes into creating them.

Most business credit bureaus create three different scores for each business. They do this because all credit bureaus are in the business of selling data or the analysis of that data to guide lending decisions. So major retailers, suppliers, and lenders rely on bureaus like Experian Business, Equifax Business, Credit Safe, and Dun & Bradstreet (and others like SBFE run by LexisNexis) to provide risk modeling for credit decisions.

For small businesses there is one score you have direct control over, the payment index. Which is exactly what it sounds like, it is an index of the payment history with qualified vendors. This score ignores things like how long you have been in business, what industry you operate in, or what the owner’s personal credit score is. It only evaluates your actual performance on paying your business bills on time and is a strong indicator that your business is a less risky business to lend to.

Best Net 30 Vendor Qualifications For Credit Building.

Where do you start as a small business looking for the right partner to build your business credit and also utilize something that will grow your business? Start by understanding what the relationship is between the “Net30 Vendor” and the credit bureaus.

Before providing an example of how Growegy works with specific bureaus, it may be helpful to understand that working with credit bureaus is very restrictive. And some bureaus are difficult to work with as a vendor and as a small business owner. There are very stringent requirements (for good reason) to get approved as a credit bureau partner. These include having integrity in the reporting, operating your invoice issuing business in specific ways, data formatting, and reviews. Not all credit bureaus are forthcoming in how they evaluate partners. Credit bureaus also ask for data to be formatted differently.

All that said, some credit bureaus are wonderful to work with and are responsive to partner inquiries. They also don’t try to gouge small businesses by requiring them to pay for everything. They don’t use high-pressure sales tactics for you to see your scores.

Look at each Net30 vendor and who they advertise they work with. Understand that the relationship with a bureau is an active one, while reports may be sent in regularly, there is still data validation, or even the possibility of an audit. The terms of the Net30 account (also known as a tradeline account) are — at least in part — determined by the reporting requirements.

Growegy as an example, has regular communication with Experian Business and Equifax Business. We provide monthly reporting to these bureaus and know they carry a lot of weight in the business lending world. As of the date of this article, we have periodic communication — and sometimes tradeline verification — with bureaus like Dun & Bradstreet and Credit Safe.

Check out this list of potential vendors (no affiliation, external link)

Personal Guarantees And Credit Checks.

Saving the owner’s personal credit from unnecessary hard inquiries is important for most new and small businesses. Many start an LLC — among other reasons — to separate personal and business credit. In order to maintain an LLC and the protections afforded under an LLC you must be careful not to pierce the corporate veil by commingling funds or other such practices.

Lending in general is all about managing risk. Many vendors ask themselves: Who are you lending to? Are they a registered and verifiable business? How much are we lending? Should we pull someone’s personal credit? And therein lies the rub, you started a business venture and want to keep things separate but you can’t fully get away from the owner’s history. In particular there are Know Your Customer (KYC) laws in place that require customers to be verifiable.

The higher the credit limit and the type of credit typically determine a hard inquiry. For example, a universal line of credit or credit card, even in the business name, often comes with a hard inquiry. Get too many inquiries in a year and you are almost guaranteed to be denied regardless of payment history and scores. So protecting your personal credit is a must.

This is why businesses that offer Net30 terms (aka Net30 Vendors, Vendor Credit, Tradelines) are so critical. We bridge the gap between no credit history and future goals in acquiring lending. We are taking you at your word, as the owner, or managing member of the business, that you will abide by the terms set forth in the application.

We do not ask for a personal guarantee, forcing you to collateralize our products and services, meaning:

- We do not have a guaranteed way to recover our losses

- We do not report violations of the agreement to personal credit bureaus

We do however report positive and negative interactions of your payment history to the bureaus listed above. So the downside to your businesses poor performance means it will be harder for you to get funding later from those that will reference our reports via a credit bureau.

We do not check your personal credit — soft or hard inquiries — before approving your application. We validate your business identity and your registration to act on behalf of the business in our approval process (again KYC and Bureau requirements). This is the second way that a Net30 Tradeline Vendor like Growegy benefits your business; we take the risk of doing business with you regardless of your personal credit history.

Check out Growegy’s net30 application.

How Long Should You Use Net 30 Accounts?

We mentioned earlier that most business credit bureaus have scores like a “payment index” and most are on a scale of 1 -100. Essentially the higher your score the better. It is a numerical representation of whether you pay on time, early, or late. 80-90 typically means “on time”. Most credit bureaus establish their scores after 4-6 months and the scores stay in place until there is a reason for them to change.

After 12 months, most payment history isn’t seen as relevant, so scores are calculated on a rolling 12-month basis. The average of your tradeline payment history from 13 months ago doesn’t matter as much or in some cases at all. There is another way that your credit history matters beyond the score, it shows you are active, have a longer history of paying on time, and that affects multiple scores and calculations of approval on more advanced lines of credit.

Ideally, you should create and maintain credit history so that you have positive activity to show in any rolling time frame. Especially if you are seeking to obtain lines of credit, loans, or other forms of lending matter to the future of your business. You can do this with monthly accounts offered by vendors, or on an annual basis (like Growegy’s annual plan) where you get accelerated benefits, account management, and the latest in AI technology to grow your business.

Lack of capital, funding, revenue or access to capital is one of the four major reasons why companies fail within 2 years. Credit history and credit scores are the beginning of access to capital. We are proud to support the small business community by getting you started on the journey. Want to see what the other three reasons that businesses fail are? We regularly post about these issues on our blog, but you can also check the SBA’s report.

Why Do Businesses Fail? Read The SBA’s Top 4 Reasons (external link to the SBA’s report).

Follow Us

Download

© 2020-2025 Growegy. All rights reserved