Beneficial Ownership Information Reporting Requirements

Small entity compliance guide FAQs

Effective January 1, 2024, the US government (along with partner foreign goverments), require most businesses to provide identifying information for who owns or indirectly or directly controls a business.

This intro article will focus on US companies that have filed entity documents with a secretary of state. The official published guides are more detailed and linked to at the bottom of the article. It is strongly recommended that you reference these documents for definitions and a deeper understanding.

Please note that there is no fee for filing. And the form is hosted online.

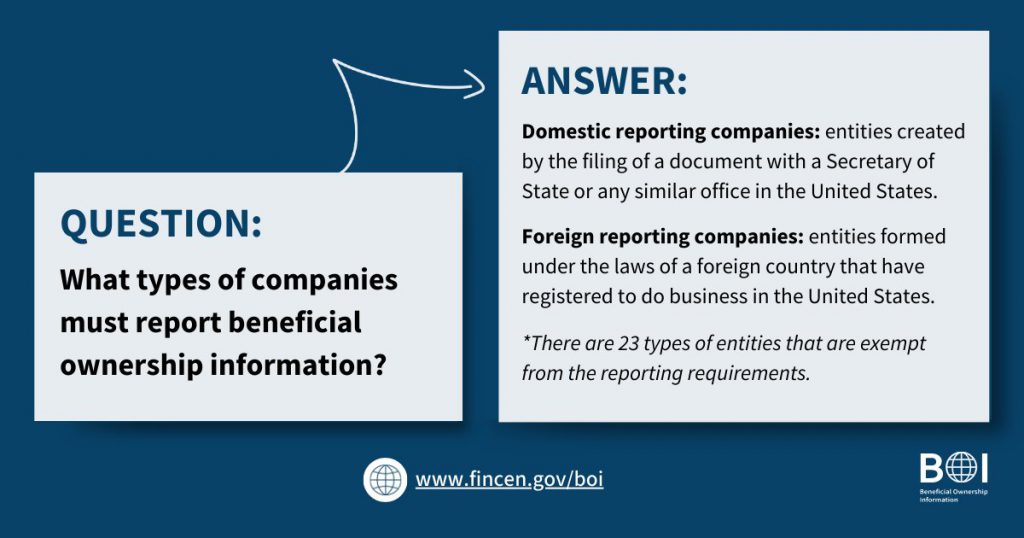

Which companies need to report?

If you are a corporation, limited liability company (LLC), or if the entity was created by filing a document with a secretary of state, similar office, or Indian tribe then you may be a domestic reporting company.

There are excluded entities as follows:

| Exemption No. | Exemption Short Title |

|---|---|

| 1 | Securities reporting issuer |

| 2 | Governmental authority |

| 3 | Bank |

| 4 | Credit union |

| 5 | Depository institution holding company |

| 6 | Money services business |

| 7 | Broker or dealer in securities |

| 8 | Securities exchange or clearing agency |

| 9 | Other Exchange Act registered entity |

| 10 | Investment company or investment adviser |

| 11 | Venture capital fund adviser |

| 12 | Insurance company |

| 13 | State-licensed insurance producer |

| 14 | Commodity Exchange Act registered entity |

| 15 | Accounting firm |

| 16 | Public utility |

| 17 | Financial market utility |

| 18 | Pooled investment vehicle |

| 19 | Tax-exempt entity |

| 20 | Entity assisting a tax-exempt entity |

| 21 | Large operating company |

| 22 | Subsidiary of certain exempt entities |

| 23 | Inactive entity |

Which people in a company need to be identified?

There are two categories of individuals that need to report for qualifying companies.

- Beneficial owners

- Company applicants (please refer to the exclusions in the official documentation)

“A beneficial owner is an individual who either directly or indirectly: (1) exercises substantial control … over the reporting company, or (2) owns or controls at least 25% of the reporting company’s ownership interests…”, as reported in the official BOI FAQs Q&A.

Which company information is required to be submitted?

“For each individual who is a beneficial owner, a reporting company will have to provide:

- The individual’s name;

- Date of birth;

- Residential address; and

- An identifying number from an acceptable identification document

such as a passport or U.S. driver’s license, and the name of the

issuing state or jurisdiction of identification document…

The reporting company will also have to report an image of the identification

document used to obtain the identifying number in item 4.”, as reported in section F.3. of the official BOI FAQs Q&A

When do I need to file by?

Companies created in the United States after January 1, 2024 have 30 calendar days to file from the date of approval/creation. Companies in existance prior to January 1, 2024 have until January 1, 2025 to complete the report.

Where do I file?

Companies will file online at the Financial Crimes Enforcement Network (FCEN) website; https://boiefiling.fincen.gov/ for more information you can visit the FCEN overview page at: https://www.fincen.gov/boi

The content provided here is informational in nature and does not constitute advice on whether you are exempt. Please check the provided documents to make the determination and consult with your legal and financial teams to make such a determination.

Follow Us

Download

© 2020-2025 Growegy. All rights reserved